Mobile robot forecast downgraded as macro-economic factors continue to bite

.jpg)

We have reduced our forecast for the global mobile robot market by 18% in 2027 because a series of macro-economic factors is impacting demand. This challenging climate has resulted in manufacturers and retailers slowing their automation investment plans and we no longer expect a rapid uptick in AMR deployments before 2027.

Our new report outlines how governments have struggled in the aftermath of the pandemic, how the retail industry is still going through a post-Covid correction, why China’s economy is weaker than expected, and how automotive has been hit by slow uptake of electric vehicles. These external factors, coupled with 60 countries holding elections in 2024 and conflict in Ukraine and the Middle East, have constrained demand for mobile robots. Price declines are also slower than forecast, which has in turn slowed uptake.

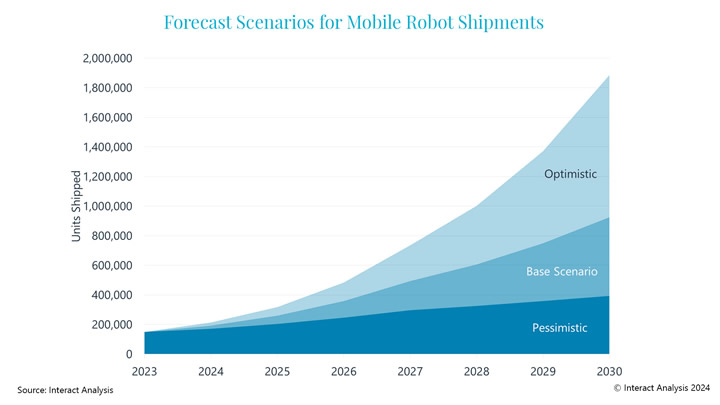

Despite our more cautious forecast, the outlook out to 2030 is still for double digit growth, and we have created optimistic, base, and pessimistic scenarios (see below).

In our most bullish prediction scenario, mobile robot shipments could reach nearly 2m by 2030.

Range of factors cause constrained mobile robot market growth

Our survey of 300 buyers of mobile robots shows they expect automation spending to increase in 2024 by a mean average of 18% compared with 2023. National elections in 2024, continued global economic weakness and ongoing conflicts are expected to cause short-term dips in spending, with the latter continuing to push up energy costs and disrupt supply chains.

We now forecast customer uptake will carry on growing at a linear rather than exponential rate, while price declines will be slower than previously anticipated as labor costs increase, preventing an avalanche in demand. The post-Covid correction has been prolonged as consumers return somewhat to pre-2020 buying habits, and consumer spending has been impacted by high inflation and interest rates. Nonetheless, companies are continuing their automation plans to mitigate risks associated with labor shortages, rising wages and economic uncertainties, ensuring business continuity and resilience. Mobile robot investments are by and large getting much bigger in size, and the associated due diligence and internal scrutiny is prolonging sales cycles. This double-edged sword causes some turbulence for robot vendors and, at the same time, plenty of upside potential. With that in mind, we predict mobile robot revenues will reach $5.5 billion in 2024 and grow at more than 20% annually up to 2030.

China continues to experience tough market conditions

China remained the largest market for mobile robots in 2023, contributing over 70% of the increase in unit shipments – underscoring its role as a manufacturing powerhouse. However, due to lower relative prices in the region, this accounted for only 32% of the total revenue increase. Weakening domestic demand in China has accelerated efforts by Chinese vendors to grow in international markets. Increasing discontent in Europe and the US over Chinese vendors undercutting domestic suppliers (outside of the mobile automation sector) raises the prospect of tariffs being introduced, which could also impact mobile robots. However, recently announced stimulus policies in China are expected to boost domestic demand over the next few years.

Long-term outlook for mobile robots remains strong

Despite the less favorable mid-term outlook, we are still anticipating double-digit revenue growth of 20-30% annually out to 2030 and the overall long-term picture remains positive. This follows growth of shipments in 2023 of 23%, reaching almost 150,000 over the year.

The global blended Average Revenue Per Unit (ARPU) remains relatively stable due to the rising cost of labor and a shift in product and geographic mix. ARPU dipped by just 3.1% in 2023, a similar drop to 2022. The ongoing skills and labor crisis in industry is likely to see pricing maintained in the future as ROI on mobile robots becomes increasingly easy to achieve.

Labor shortages and rising wage costs fuel automation demand

The installed base of mobile robots is projected to exceed 4.2 million at the end of 2030, with nearly 1 million to be added in 2030 alone (and this excludes those used by Amazon). The labor shortage remains the biggest driver of demand for mobile robots, exacerbated by rising labor costs and the near-shoring and re-shoring of manufacturing. However, high upfront costs, lack of interoperability, competition from fixed automation, and rising inflation and interest rates are significant barriers to mobile robot adoption. Reducing prices and the introduction of Robotics-as-a-Service (RaaS) and leasing models are helping to overcome these hurdles.

Chinese vendors dominate, but Western competitors are growing

Chinese vendors continue to dominate the global mobile robot market, generating nearly half of all global mobile robot revenues and two-thirds of shipments in 2023. Companies like Geek+, HikRobot, and Quicktron lead the market, with strong growth both domestically and internationally. These companies mainly manufacture in China and so will be vulnerable to possible future tariffs in the US (and possibly Europe).

Despite numerous acquisitions, the mobile robot market is not consolidating, as most acquisitions to date are by non-mobile robot companies. For example, Rockwell Automation acquired Clearpath Robotics (OTTO Motors). More vendors emerge each year and more industrial companies are launching AMRs, so the share of the top 10 and top 20 leading vendors has barely changed since 2018.

Chinese vendors continue to dominate the global mobile robot market.

Conclusion: A thriving market despite challenges

The mobile robot market is poised for continued growth, driven by strong underlying macro factors: labor shortages, rising labor costs, and shifts in consumer buying patterns and manufacturing strategies. Despite present challenges, the industry’s long-term outlook remains positive, and we forecast more than 160,000 customer deployments in 2030.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product