The industry value chain is changing. We’re seeing a shift away from highly customized fixed automation solutions to more modular, configurable, and standardized systems, like AutoStore and OPEX. This will have far reaching implications on the industry’s value chain.

The Warehouse Automation Industry Structure is Changing: Are You Ready for Disruption?

The Warehouse Automation Industry Structure is Changing: Are You Ready for Disruption?

Rueben Scriven, Research Manager | Interact Analysis

Rueben is one of the warehouse automation industry’s leading analysts and is a regular speaker at leading industry events. He has moderated several panel discussions on the topic of commercial vehicle electrification and has also appeared on CNBC, providing insight on the global electric bus market.

The industry value chain is changing. We’re seeing a shift away from highly customized fixed automation solutions to more modular, configurable, and standardized systems, like AutoStore and OPEX. This will have far reaching implications on the industry’s value chain, eroding margins for system integration and solution design, while benefiting system OEMs. During this insight, we’ll be discussing the following topics:

-

The current industry structure and how it developed.

-

The rise of more modular, plug-and-play systems and the impact this will have on the industry.

-

How companies can position themselves to capture the most value given the current industry trends.

The Traditional Model to System Integration

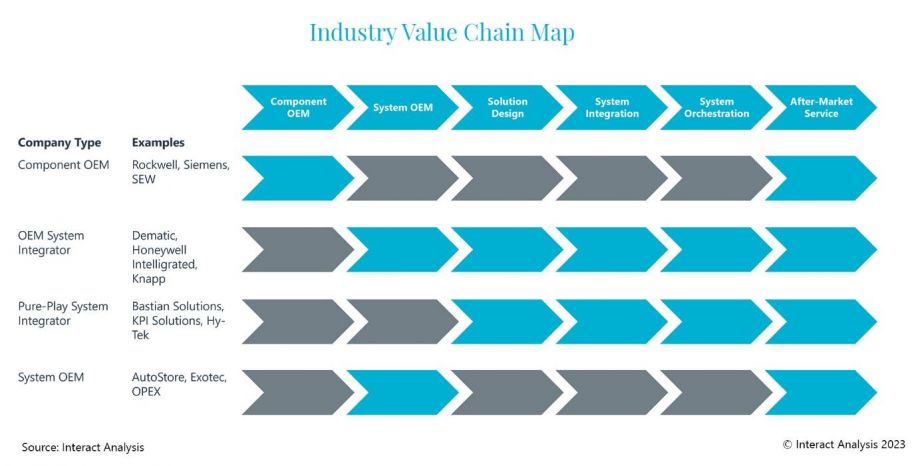

There are several steps in the warehouse automation value chain as depicted below. Most warehouse automation system integrators cover the span from system OEM all the way to after-market service (as depicted in the table below). One of the reasons for this vertical integration is due to the high level of commoditization of traditional fixed warehouse automation hardware (e.g. shuttles, conveyors, sorters etc). A lack of differentiation and a relatively slow pace of innovation has shifted the buy-vs-build decision firmly to the ‘build’ side. For example, Witron acquired FAS in 2005 in order to bring OEM capabilities in-house. On the other hand, system OEMs, struggling in a low margin business, developed integration capabilities in the pursuit of higher margins. For example, TGW – which was originally a system OEM, developed integration capabilities. This led to the current state of the industry where the bulk of revenues are generated from OEM system integrators.

Different company architypes map on to the value chain

The Rise of Modular and Standardized Systems

In recent years we’ve seen several third-party system OEMs enter the market developing highly modular and standardized solutions that tend to be based around robotics (as opposed to traditional conveyance), such as Exotec, AutoStore, Dexterity, and Berkshire Grey. This is shifting the buy-vs-build decision for system integrators in favor of ‘buy’ due to the rapid rate of innovation surrounding these technologies, coupled with the lack of in-house robotic expertise. Because the market is changing at such a rapid pace, incumbent system integrators don’t want to bet big on a single acquisition target or look to develop technologies in-house because end-customer preferences may have shifted by that time.

This is leading to the growth of pure-play system integrators, which focus primarily on integrating hardware from these third-party system OEMs like AutoStore and Exotec. For example, when it comes to the top 10 system integrators in the US last year (2022), nearly all OEM System Integrators lost market share, while the opposite was true for pure-play system integrators. Even ‘conventional’ OEM System Integrators are starting to partner with more system OEMs. For example, Dematic – the quintessential OEM System Integrator – partners with AutoStore, Dexterity, and Quicktron. The trend towards system integrators partnering with system OEMs is clearly on the rise.

The novel systems developed by the likes of AutoStore, Exotec, OPEX, and other third-party system OEMs are highly modular and configurable. This contrasts with legacy equipment (often conveyance-based), which tend to be highly customized and bespoke for each client. The shift from customized to standardized is, in effect, shifting the value creation from the build-phase to the design-phase.

The Value Chain is Shifting

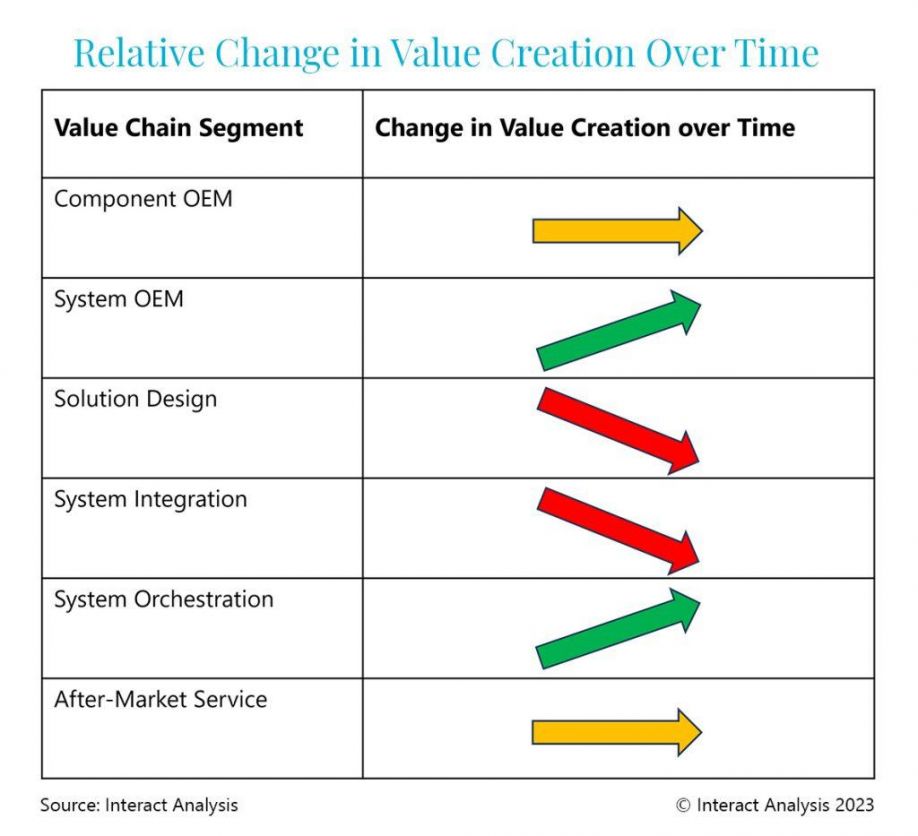

At present, a lot of the value is created in the integration/build phase because it’s often highly customized and requires extensive software, electrical, and mechanical engineering competencies in order to build these systems. Without the extensive knowledge and skills, it would be extremely difficult to provide a bespoke automation solution.

However, the relative ease with which these novel third-party solutions can be ‘connected’ together is lowering the barrier to entry for system integrators, which has the potential to erode margins for system integration over time. Furthermore, companies like SVT Robotics are accelerating this trend, making it easier than ever to integrate third-party solutions using simple and intuitive user interfaces. As we mentioned earlier, this is shifting the ‘value’ from the build-phase to the design-phase.

This isn’t to say that system integration will become ‘easy’. However, the trend towards greater standardization means that there’s less customized code required to integrate various systems together, and the ‘plug-and-play’ nature of these modular and configurable systems means that there’s less of a requirement for extensive electrical and mechanical engineering competencies.

The value is shifting from build to design. Note: Estimates for EBIT margins for each activity are presented in the Warehouse Automation – 2023 report.

As we start to see the integration of more third-party systems, the need for system orchestration and execution becomes increasingly critical. We expect there will be a lot of value created in connecting and orchestrating these disparate systems.

The shift towards using third-party system OEMs also raises the question of who will own the after-market service margins. Typically, OEM system integrators have captured the bulk of the MRO and other after-market service revenue. However, we’ll likely see more System OEMs capturing the MRO revenue, particularly when it comes to spare parts.

A Universal Phenomenon

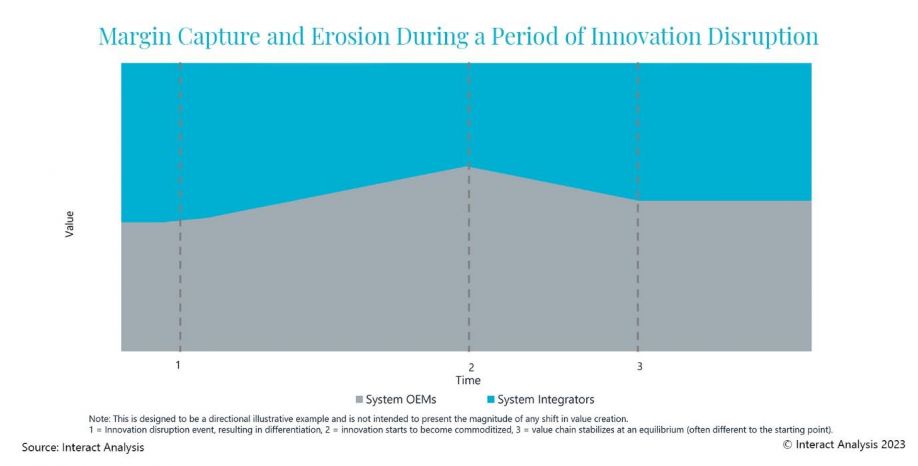

The impact robotics is having on the value chain isn’t limited to the warehouse automation market. Across Interact Analysis’ various research areas we’ve observed a common pattern across sectors experiencing innovation disruption. Value creation shifts downstream to the vendors developing the innovative systems, while vertically integrated participants upstream in the value chain experience value erosion.

Take the automotive sector, for example. Historically, OEMs like VW and Volvo would manufacturer most of the components used in vehicles, including the powertrain. However, with the shift towards electrification, we’ve seen a trend whereby the tier-1 suppliers are leading innovation and capturing more of the value by developing new and improved batteries and electric motors. As such, the ‘value’ that the OEMs offer is eroding over time as the tier-1 suppliers capture more of it.

Shift in value during a period of innovation disruption

Going Full-Circle

However, nothing lasts forever. At some point, the rate of differentiation will slow and hardware will become commoditized. At this point, we’ll likely see two things: 1) system OEMs developing integration capabilities in an effort to chase higher margin opportunities, and 2) incumbent system integrators acquiring system OEMs. The result will be an industry dominated by vertically integrated system integrators, taking us full circle.

Staying Ahead of the Competition

Our leading research, which draws insight from primary research, data science, and strategic analysis, provides a surefire way to stay ahead of the curve and weather the ensuing disruption. We’ve just published our Warehouse Automation – 2023 report which provides extensive insight into growth segments and competitive advantages, along with a wealth of market forecast and market share data. Furthermore, our custom research solutions are at the leading edge of warehouse automation strategy and our clients get access to our analysts all year round. To find out more, email rueben.scriven@interactanalysis.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product