The trend of investment in and acquisition of mobile robotic companies seeking to automate the movement of goods within warehouses, fulfillment centers, and manufacturing facilities is still rising. Only in recent months, IDTechEx has seen three notable activities.

Autonomous Mobile Robots in Warehouses: IDTechEx Asks What Justifies the Recent High Valuations

Autonomous Mobile Robots in Warehouses: IDTechEx Asks What Justifies the Recent High Valuations

Research from | IDTechEx

The following discussion is based on our report "Mobile Robots, Autonomous Vehicles, and Drones in Logistics, Warehousing, and Delivery 2020-2040". This report provides a comprehensive analysis of all the key players, technologies, and markets. It covers automated, as well as autonomous carts and robots, automated goods-to-person robots, autonomous and collaborative robots, delivery robots, mobile picking robots, autonomous material handling vehicles such as tuggers and forklifts, autonomous trucks, vans, and last-mile delivery robots and drones.

IDTechEx provides technology roadmaps and 20-year market forecasts, in unit numbers and revenue, for all the technologies outlined above (13 forecast lines). IDTechEx built a 20-year model because their technology roadmap suggests that these changes will take place over long timescales. In their detailed forecast, IDTechEx clearly explains the different stages of market growth and outlines the key assumptions/conditions, as well as data points that underpin their model.

Recent acquisitions: why companies pay such high multiples

Canvas Technology, a company based in Colorado, had developed an advanced navigation technology, enabling its mobile platforms to achieve intelligent autonomous mobility. The company had developed navigation algorithms based on high-definition RGB cameras, enabling the robot to detect and classify objects. This is an advancement over earlier generations in which the navigation was achieved using only 2D ranging lidars. The additional object detection and classification capability enable the robot to operate in more dynamic, complex, and challenging environments and to achieve more intelligent path planning in response to different objects and environments. In short, it puts the company on a technology roadmap with ample room for development and improvement.

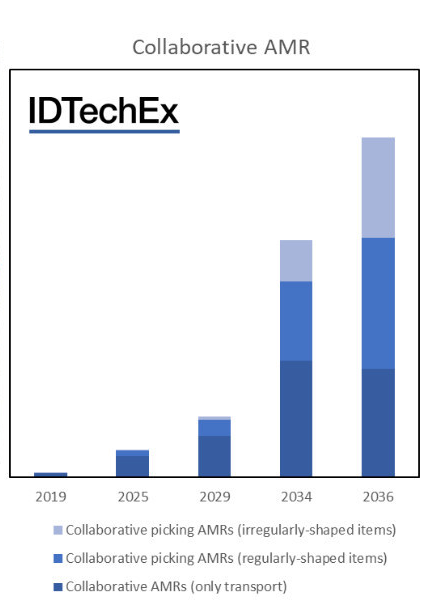

Market projections in unit numbers for collaborative mobile robots. We can see that picking robots will start to grow their share in the long run.

Previously, Amazon famously acquired Kiva Systems in 2012 for a huge $775 million. This technology has allowed Amazon to boost the productivity of the latest generation of its fulfillment centers by automating the goods-to-person step. The robot fleet is estimated to have increased at an approximate rate of 15k or so robots per year and was estimated to have recently reached 100k units.

The latest acquisition should be seen within the same trend of automating fulfillment. The technology of Canvas allows automation to be implemented in existing centers whose infrastructure cannot be readily altered to enable Kiva-like goods-to-person autonomy. Furthermore, this technology gives an excellent pathway towards autonomising larger vehicles, such as forklifts and tuggers. As such, it extends Amazon's capability to all manner of vehicles and situations found in fulfillment automation. Amazon considers this a core strategic competence.

Shopify acquired 6 River Systems for $450 million (60% cash), which represents a huge multiple, probably in excess of 20-23. 6 River systems had previously raised $45 million, and in the summer of 2019, their robots were deployed in 30 customer sites (some using the eight-robot start kits and some having as many as 50 robots in a building). It does have a strong sales pipeline, which could result in >500 robot unit sales in 2020. However, this uptick in sales on its own does not justify the valuation.

6 River continues to operate as normal with an interesting technology. Shopify CEO states "We will continue to operate, build and sell 6 River Systems solution, in addition to making it available to our warehouse partners. As a result of extending this innovative technology beyond Shopify's current market, not only are we helping to change the broader fulfilment industry, we're also expanding our total available market.”

The majority (70% or so) of 6 River Systems 150-person team are focused on the software aspects. Within the software team, the smaller sub-team focuses on autonomy algorithms and the larger sub-team on cloud-based fleet and task management software.

On the autonomy side, 6 River uses both lidars and cameras. The lidar map, built during the initialization phase, is curated by engineers, uploaded onto the cloud, and used by the fleet within that specific environment. Camera technology could also enable it to detect and classify objects, thus achieving more responsive path planning algorithms. On the higher-level software, they develop algorithms to optimize the movement of the fleet to achieve reliability and speed in fulfilling multi-item requests. They can also share learnings amongst the entire fleet via the cloud, setting in place a learning loop that could enable the algorithm to be constantly improved. These technology choices - with regards to both autonomy and cloud-based fleet/task management - place 6 River in a good position in the short and long terms.

Editors Recommendation "Artificial Intelligence Drives Advances in Collaborative Mobile Robots"

Shopify was motivated to make this acquisition, as in June 2019, it announced the Shopify Fulfillment Network. 6 River's vertically integrated full-solution approach allowed Shopify to bring the entirety of a key strategic competence inhouse. The technology will likely be initially rolled out at select 3PLs before Shopify puts in place its own infrastructure.

The taking off the market of another mobile robotic company through acquisition will put third part fulfillment center operators in a difficult position as to which technology to adopt in the future. This suggests that system interoperability and ease of integration with an existing automated system will become important in the future, as operators do not want to be blind-sided again

Another acquisition this year was that of Teradyne, paying $165 million ($58 million in cash and the rest if certain performance targets are reached) for AutoGuide, a company with barely $4 million in revenue in 2018. Teradyne 1.5 years ago acquired Mobile Industrial Robots (MiR) for $148 million. MiR developed SLAM-based mobile platforms, mainly acting as low-payload deck-load mobile conveyors. Teradyne had also acquired Universal Arms (UR) for $227 million in 2015. UR is the pioneer and leading supplier of collaborative arms. Teradyne also owns Energid.

This acquisition - if the entire $165 million is realized - represents a huge multiple, even when considering the projected doubling of the revenue of the target company. This acquisition enables Teradyne to expand its product portfolio in the warehouse and logistics automation business. In particular, it complements MiR's product line-up, bringing it to the AGV (Automated Guided Vehicle), as well as SLAM-based, high-payload vehicles such as tuggers. As such, it exposes Teradyne to every sector of the market, even if the acquired firms are operated as stand-alone concerns.

The SLAM-based navigation is lidar-based. This technology based on natural feature extraction can also be used in forklifts, giving the firm the chance to expand its product portfolio further. Indeed, an interesting choice made by AutoGuide was to design its own platforms in a modular way, enabling one tool to be changed into another in a short time. The choice to make its own platforms also give the company vertical control, eliminating the risk that a third-party supplier unexpectedly changes a feature in the platform which would put the autonomous fleet at risk.

Many firms in this space have also raised notable funds. One prominent example is Geek Plus (China), which has raised $389 million since 2015. The firm is pursuing an aggressive expansion strategy. It has delivered over 7K units of its fiducial-based goods-to-person robots, which operate in the same was Amazon's Kiva Systems. The company is now expanding its production capability and tipping its toes into the area of autonomous forklifts. The additional capital is justified on the basis that there is significant merit in having a large installed fleet (market share). Furthermore, the capital is required to invest in production capacity.

Another firm in the same field that has raised notable sums is GreyOrange. It raised $140 million in 2018, bringing its total to $170 million. This Indian firm, with offices in Singapore and now the U.S., has a well-engineered product and has recently announced winning large-scale deployment orders.

We assess that the market for how such autonomous mobile robots (AMRs) will grow. There have also been prominent investments and acquisitions this year, e.g., by Shopify and Amazon. Overall, we forecast that more than 200k robots could be sold within the 2020-2030 period (this figure includes those that can perform picking of regularly or irregularly shaped items). To learn more about various companies, market and technology trends, and to access our detailed market forecasts, please see the report "Mobile Robots, Autonomous Vehicles, and Drones in Logistics, Warehousing, and Delivery 2020-2040".

Picking mobile robots to dominate AMRs?

Picking or grasping technology is an essential component of warehouse automation. Today, many firms and research groups are deploying deep learning to enable robots to pick novel and irregularly shaped items rapidly and with high success rates. To this end, various strategies for data collection/annotation and for DNN training are being followed.

A limited number of firms have integrated picking arms on mobile platforms. Today, these mainly picked box-shaped items in known environments. However, technology progress will bring these technologies to more varied items. It will also allow better integration of the robotic arm with the mobile platform.

We forecast that picking mobile robots able to pick regularly shaped items will be in the learning and low volume deployment phase until 2024. Thereafter, the sales will pick up. However, only after 2030 do we forecast significant annual sales volumes. As for robots able to pick irregularly shaped items, we consider that the development and low-volume deployment phase could last until 2030. In the longer term though, we forecast that 36% and 38% of AMRs in warehouses sold in 2040 will be able to pick regular - as well as irregular-shaped items, respectively. This points towards a major technology transformation, requiring automation beyond just autonomy of movement.

The report "Mobile Robots, Autonomous Vehicles, and Drones in Logistics, Warehousing, and Delivery 2020-2040" provides a comprehensive analysis of all the key players, technologies, and markets. It covers automated as well as autonomous carts and robots, automated goods-to-person robots, autonomous and collaborative robots, delivery robots, mobile picking robots, autonomous material handling vehicles such as tuggers and forklifts, autonomous trucks, vans, and last-mile delivery robots and drones.

To connect with others on this topic, join us at The IDTechEx Show! Europe 2020, May 13-14, Estrel Convention Center, Berlin, Germany. Presenting the latest emerging technologies at one event, with seven concurrent conferences and a single exhibition covering Electric Vehicles, Energy Storage, Graphene, Internet of Things, Printed Electronics, Sensors and Wearable Technology. Please visit www.IDTechEx.com/Europe to find out more.

If you like this article you may like "Is Software the Future of Robotics?"

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product