The worldwide market for the agricultural robot has seen a boost in 2015 and many new products that are in field tests are expected to be commercially available by 2016.

Driverless Tractors and Drones to be Among the Key Applications for Agricultural Robots

Manoj Kumar Sahi & Clint Wheelock | Tractica

Around the world in recent years, there has been an increase in the number of large, midsized, and startup companies showing deep interest in the development and deployment of driverless tractors, aerial surveying of farmlands, data collection, field management, and cow milking systems. Moreover, the demand for the robots involved in various agricultural processes like harvesting, pruning, weeding, pick-and-place, sorting, seeding, spraying, and materials handling has increased significantly.

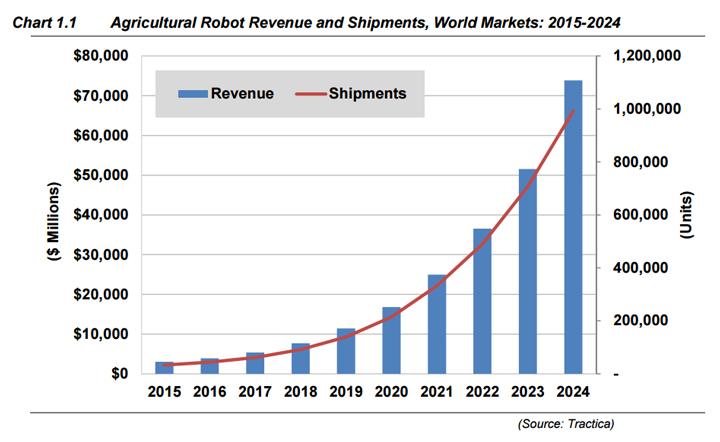

Tractica expects that the market for agricultural robots will develop rapidly in the next 5 years, as compared with the previous 5 years, while providing significant market opportunities to various market participants. Tractica anticipates that the overall agricultural robot market will reach $3 billion by the end of 2015. The market is anticipated to maintain a healthy growth rate and will reach $16.8 billion by the end of 2020. Tractica forecasts that the market will continue its momentum further to reach $73.9 billion by 2024.

This report examines global market trends for agricultural robots and provides 10-year market sizing and forecasts for agricultural robot shipments and revenue during the 2015 to 2024 timeframe. The report focuses on market drivers and market challenges, as well as assessing the key technology issues that will influence market development. In total, 42 key and emerging industry players are profiled. Market forecasts are segmented by world region and application type.

MARKET DYNAMICS

The demand for agricultural robots is driven by the global trends of population growth, increasing strain on the food supply, availability of farm workers, the challenges and complexities of farm labor, the cost of farm workers, shrinking farmlands, climate change, the growth of indoor farming, and the automation of the agriculture industry. Tractica segments the agricultural robotics market into seven key application areas:

- Driverless Tractors

- Unmanned Aerial Vehicles (UAVs)

- Material Management – handling, packaging, sorting, pick-and-place, etc.

- Field Crops and Forest Management – seeding, spraying, harvesting, surveying, etc., including horticulture

- Soil Management – tilling, weeding, fertilizing, nutrient management, etc.

- Dairy Management – milking, dairy analytics, etc.

- Animal Management – feeding, caring, grooming, breeding, etc.

While there are a number of drivers for the agricultural robotics market, barriers and challenges still exist that could restrict its growth. These challenges involve awareness about robots among growers, risk for farm owners due to insufficient proven robotic solutions, unclear value propositions for technology developers, fragmented non-collaborative developments across the world, changing farm size, difficulty in replacing human-like dexterity, and lack of administrative support, regulations, policies, interest, and intent.

Apart from the market challenges, the industry faces technological issues, as well. These include the heterogeneity of the operating environments for robots, problems in precise identification and classification of targets and obstacles by the robots, underdeveloped outdoor positioning and navigation technology, complexity involved in agricultural processes, safety of farm workers and undefined industrial standards, and the mismatch of outdated farm layouts with new robots.

STRATEGIC RECOMMENDATIONS

Companies that are already involved in agricultural robotics must understand that the market is in its early stage of growth; for sustainable growth in revenues, they will need a lot of innovation and clear value propositions. The market is looking for more efficient solutions in terms of time, labor, and energy, rather than perfect ones. Large companies should focus on the key areas that need infrastructural changes in agriculture, instead of building products for lesser-known agricultural issues. Medium-size and startup companies can look for opportunities to fit as complementary players with the large companies.

Tractica believes that it is important for companies that want to enter the agricultural robotics market to build field robotic technology capabilities first, including software. These companies should look for robotic and agricultural expert panels and various user groups to correctly analyze their timing, positioning, and value propositions. A well-planned and executable roadmap for business and technology will ensure smooth entry in the near term and in the future.

Currently, Tractica does not see much market competition among various players. The competition is mainly between the large companies that want to expand their businesses to new geographic locations and the startups that are trying to solve the same problem in the same way. Tractica believes that the market will require a highly collaborative and cooperative ecosystem in agricultural robotics, which will ensure that the best technologies are in place for the production of food.

GLOBAL MARKET FORECAST

The worldwide market for the agricultural robot has seen a boost in 2015 and many new products that are in field tests are expected to be commercially available by 2016. Tractica forecasts that worldwide shipments of agricultural robots will grow from approximately 33,000 in 2015 to almost 1 million units in 2024, increasing at a compound annual growth rate (CAGR) of 46% during that period. Worldwide agricultural robot revenues will grow from $3.0 billion in 2015 to $73.9 billion in 2024, at a CAGR of 43%.

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product